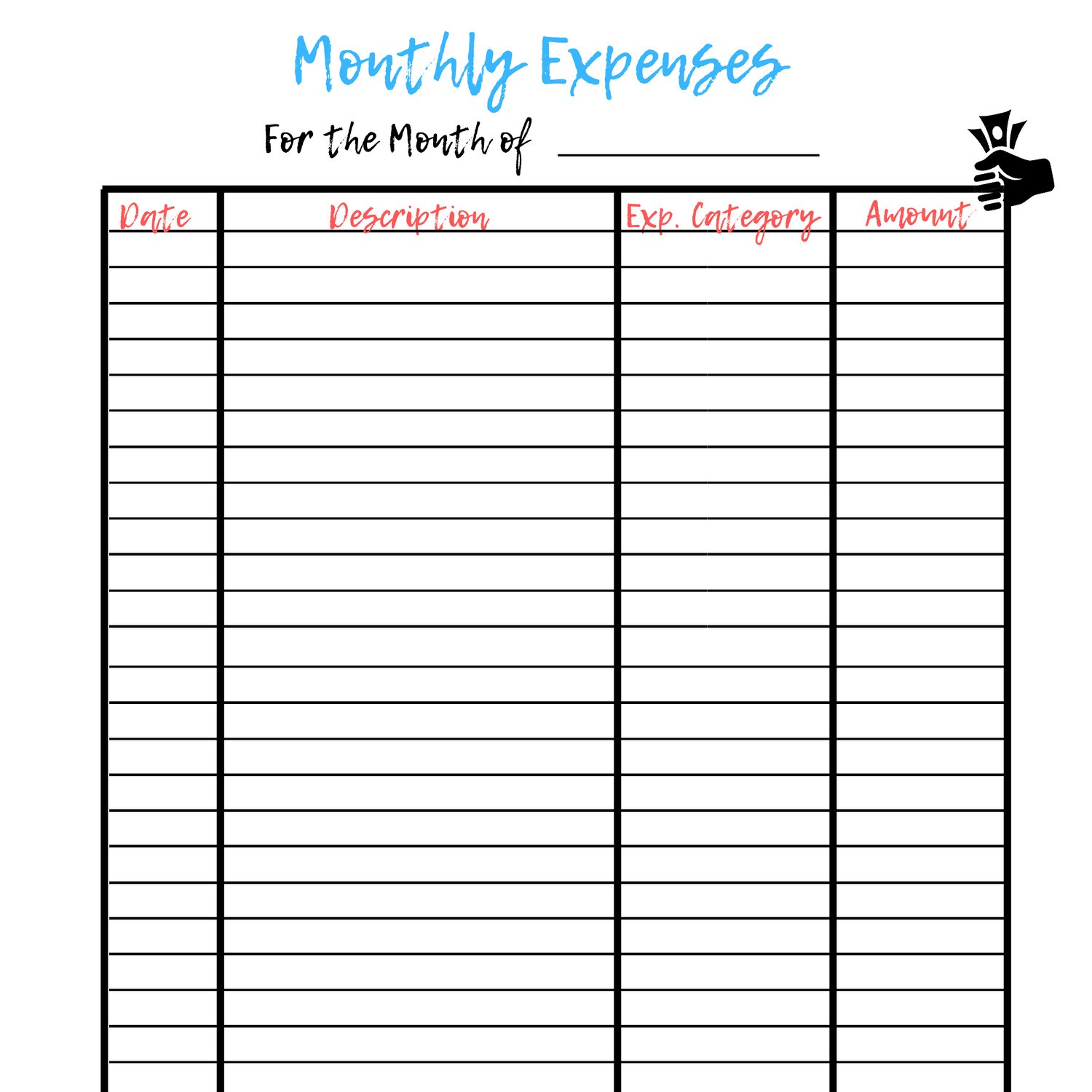

If you only have a few expenses, keep your template simple. If you’re mostly expensing travel with a personal vehicle, you can create a mileage expense tracker template by adding a column for miles driven. You can customize your template to be broken down into those categories, with different totals for each. As an employee, you have many costs in different categories. You can customize a spreadsheet to automatically include recurring expenses or add up expenses later for long-term analysis. A monthly expenses template is especially important for your business to understand costs. Businesses can create templates for monthly, recurring, and long-term expenses. You can even convert them into Microsoft Excel spreadsheets for easy filling. Having a template can also keep you from forgetting important details, like including dates.įortunately, templates are also completely customizable to your own needs.

#Business monthly expenses template download

To avoid unnecessarily starting from scratch, download an expense report template like the one linked above.

#Business monthly expenses template professional

This will make them easier to scan later for a more professional look. Then, place receipts in an envelope or file in chronological order. As soon as you have a receipt, take a picture of it, just in case it ends up getting lost. Your system should focus on keeping receipts or other necessary documentation. It might help you to use one card for only business needs so that you can go back and make sure you’re tracking every transaction and don’t miss any qualified expenses. Whether you’re a business or an employee, create a system that helps you remember everything you need to submit. Keep these documents and receipts neat and organized. You’ll also want to ensure you know which document (usually proof of purchase) your employer wants attached to your expense report. If you’re traveling with a personal vehicle, learn how mileage reimbursement works. If you’re going on a business trip, figure out whether you’ll have a per diem, a company card, or simply request reimbursement of all of your expenses after the fact in an expense report. This means that if they haven’t already clarified, make sure you know which expenses they will cover and which they won’t. If you’re an employee, you’re accountable to the business you’re seeking reimbursement from. Expense reports will play a huge role in understanding the financial success of your business. You might be wondering, “How do I create an expense template?” You can start by downloading the template below and customizing it to your needs.įirst, establish expectations with the authorities you’re accountable to financially.īusinesses need to know about tax laws, deductions, audits, and general accounting best practices. A template can also guide employees and ensure they list charges correctly. Providing a template is more orderly and can make things much easier for those that process expense reports and track costs. Workers can then complete and submit a consistent report each time they’re reimbursed. You can follow the guidelines below to ensure your expense report is effective and professional.Īs a business, however, providing workers with an expense report template is more efficient. If you work for a small business, you may be expected to submit an expense report with little instruction on what it should look like. When seeking reimbursement, employees are usually responsible for producing an expense report. This documentation tends to be in the form of receipts for business purchases. This is usually the documentation required for tax and accounting purposes. Documentation to support the listed expenses.This helps streamline processing, and it’s simple when you have an expense report template in a spreadsheet. Totals or subtotals of different cost categories.Including vendors shows not only where your money is going but who you are paying. Vendors include anything from landlords to restaurants to printing companies. It can be a crucial detail in case of budgeting updates or concerns. This can help your business understand where the money is going at a glance. This is important for accounting and bookkeeping purposes, especially in case of any scrutiny of expenses. These determine your reimbursements as an employee or your tax deductions as a business. These must be input accurately, down to the cent. While expense reports may seem tedious, the details they include are important for your company’s accounting: They allow a business to keep track of costs and create an accurate picture of profit versus revenue, and they also allow employees to get reimbursed for expenses they’ve incurred on behalf of their employer. What is an expense report, and what should it include?Įxpense reports can serve two different purposes.

0 kommentar(er)

0 kommentar(er)